Daily Nifty Analysis

nifty_24.5.2012_xDirect India

the Rupee depreciation. USD/INR in spot has marked its highest level ever at 56.30 amid weak global trends, where SENSEX after marking a 157 drop further added about 80 points fall in the same session, as weakness in thee net importing economy would indeed makes consumption more expensive.

For today, perhaps some sort of respite could be provided; however we should be watchful during the European session, wherein after a freefall in these markets that recorded a 2% fall, was witnessed, due to Greek issue and failure on providing any sort decision on Summit that was held yesterday.

Today, markets could witness some buying however; if risk aversion intensifies the buying on the counter could turn out to be a huge bout of selling.

Nifty finds its immediate support at 4804, where a breach could push it lower towards 4765 (Low of May 18th). Resistance at 4850 would be well kept for today wherein only a daily close above 4940 would be considered as a meaningful correction.

View on Indian Rupee

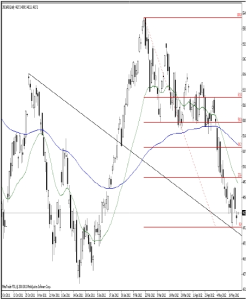

USD/INR_24.5.2012_xDirectIndia

Intra-day Outlook

Spot USDINR:

The RSI is its highest level since November 22, 2011 where constant upside has kept market to go short; however if European situation deteriorates then this would be followed by heavy selling in Euro and high yielding assets, causing US Dollar to strengthen.

For the trend we still keep our bias towards upside wherein after achieving our 1st target off 56.25. The objective remains to 56.68 for now (Both Fibonacci extensions). Supports are seen towards 55.95 and then 55.82 for today and only a daily close below 55.45 should be considered as a correction from its consistent upside.

Report by

xDirect India

www.xdirect.in

No comments:

Post a Comment